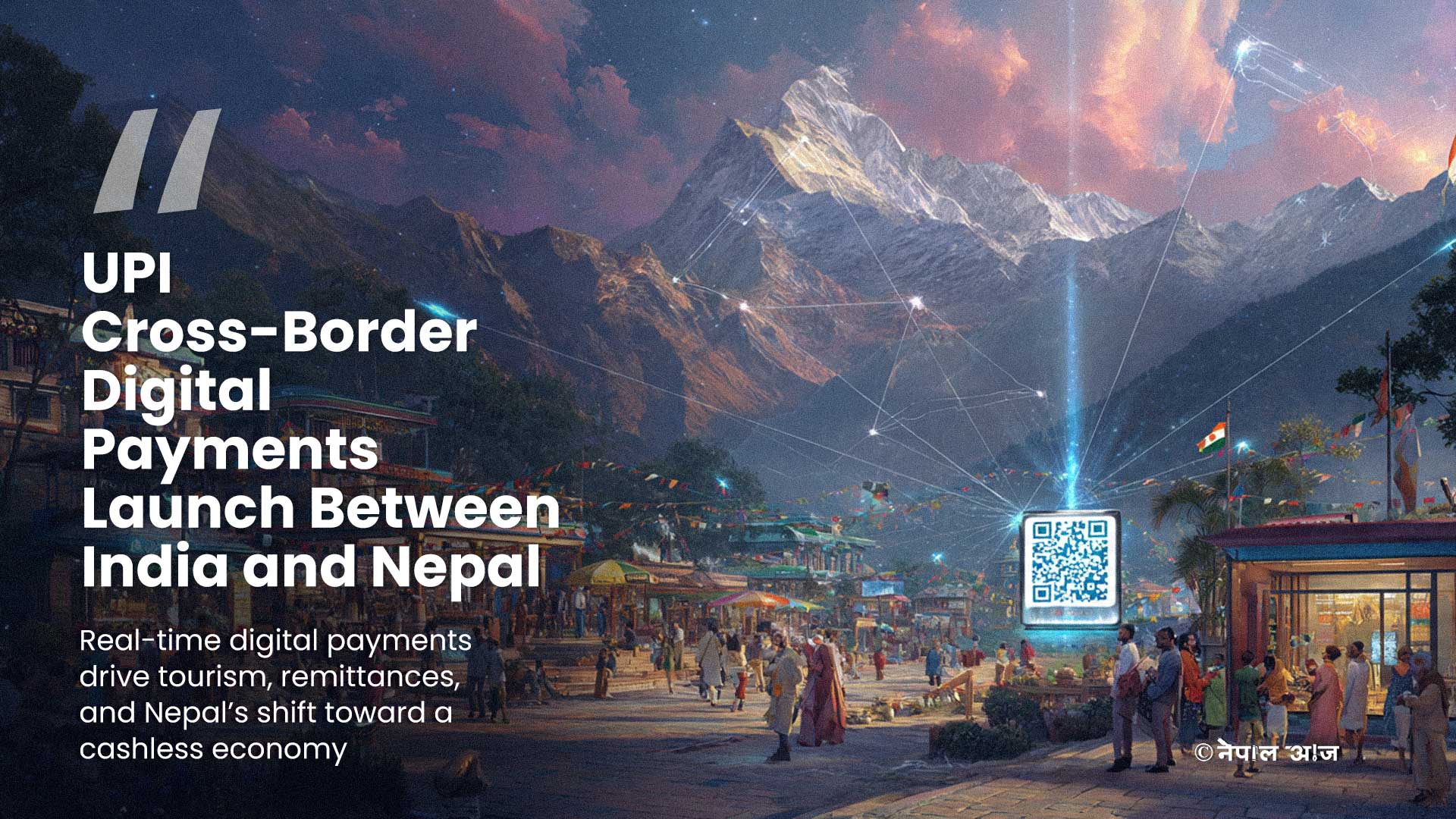

Indo-Nepal friendship strengthens through financial connectivity

Indo-Nepal relations took another step toward strengthening their historic ties—rooted in mutual trust, friendship, and cultural linkages—after Nepal became the first country to adopt India’s Unified Payments Interface (UPI) platform for cross-border transactions. This initiative has not only made payment transactions smoother and more efficient but has also helped boost local spending, tourism, and hospitality, while offering wider macroeconomic advantages to the Himalayan nation. Within six months of the integration, the number of transactions crossed 100,000.

Fonepay, which created a unified digital payment ecosystem in Nepal, said India’s real-time mobile payment system has revolutionised digital transactions, making currency exchange and spending for tourists and pilgrims hassle-free. Diwas Kumar, CEO of Fonepay, called the UPI integration a “major milestone” in Nepal’s journey toward a digital economy, as it would have a long-term positive impact on trade and tourism. “I am confident that this cross-border payment solution will significantly improve economic ties, commerce, and tourism between the two nations, eventually promoting economic prosperity and progress,” he said.

Indian Prime Minister Narendra Modi said This will benefit thousands of students, hundreds of thousands of tourists, pilgrims and people leaving for medical treatment in India as well.” The digital payments through UPI integration received a grand welcome in Nepal, as over 100 transactions were reported on the very first day. “The cross-border digital payment service is good news for the tourism industry,” said Binayak Shah, president of the Hotel Association Nepal. “The credit card is not accessible in most of Nepal’s localities. As the QR system has reached almost all areas, this will greatly facilitate tourists.”

Nepali people expressed their joy over the adoption of the novel Indian technology. “UPI is the best payment system. Nepal should join this system very easy to use and safe. UPI is the best technology India has produced so far... It turns slow bank transfers into lightning fast,” said one Reddit user from Nepal. “UPI is so awesome. India has really nailed down the digital payments scenario. The government pushed hard for UPI adoption, and people embraced it due to convenience,” quipped another.

Moreover, it has been beneficial for millions of migrants from Nepal living in India. With the new digital payment system, they are now able to make instant transfers to their families in Nepal, that too atvery low-cost. So there is no need to convert physical currency or carry it. The slow, costly, tedious and risky method of cash transfer has become a smooth experience with the facility of tracking.

Highlighting a significant foreign exchange source for Nepal’s economy, the World Bank Group’s International Finance Corporation (IFC) hailed the UPI integration as it allowed users to make instant, low-cost fund transfers, including QR code-based payments. “This move enhances financial connectivity between India and Nepal, enabling easier remittance transfers and payments for travellers and migrants in both countries,” it said in a report titled Digital Financial Services in Nepal.

The UPI integration facilitated collaboration between Nepal’s MuktinathBikas Bank and India’s PhonePe, allowing the former to offer an international QR payment service. The bank said the digital payments facility will “play an important role in the development of Nepal's economic and tourism sector by further strengthening economic and mutual relations between Nepal and India.”

Research scholar Madhav Dhakal saidIndia’s UPI can help Nepal embrace a digital economy at a faster rate. “India’s Unified Payments Interface (UPI) has changed financial access, recording over 18 billion transactions in June 2025 alone,” he said.“For Nepal, this urgent shift can bring opportunity.Financial inclusion could improve through mobile wallets, QR-based rural payments and transparent online banking.”

Indo-Nepal friendship

![From Kathmandu to the World: How Excel Students Are Winning Big [Admission Open]](https://www.nepalaaja.com/img/70194/medium/excel-college-info-eng-nep-2342.jpg)